In 2025, the automotive industry is expected to see a cautious recovery, with global new vehicle sales forecast at 89.6 million units.

With so much uncertainty and question marks as to where the industry will go in the next several months, let’s dive into the old and new trends that are impacting automotive marketing.

What’s the forecast for 2025?

14 Automotive Marketing Trends for 2025

1. Hyper-Personalization

You can no longer rely on a generic marketing blast to attract potential customers.

We are officially a quarter into 2025 and personalization is still the name of the game, if you want to catch their eyes, keep your brand top of mind, and bring in business (old and new).

The new gold standard is authentic and customized outreach.

You can reach the most actionable leads by using data. Imagine leveraging their browsing history, past purchases, service records, and (not to go Jetson’s on you, but…) even real-time driving behavior. You and your team would be able to deliver incredibly relevant and timely messages.

For instance, your customer receives a personalized offer for winter tires based on their location, and the upcoming forecast. Another customer sees a targeted ad for a larger SUV as they’re preparing for a new family member.

2. The Power of First-Party Data and Intent Signals

Last year there was a growing concern for the evolution of privacy regulations, aka the phasing out of third-party cookies. What does that mean? First-party data is more important than ever.

Automotive marketers in 2025 will need to prioritize relationship-building with their customers. The data that you source from general interactions, email engagement, in-app activity, and even during test drives is crucial to future campaigns.

Likewise, you’ll want to identify and act upon intent signals – reaching out to customers based on their online searches. This includes consumers who are researching specific models, making comparisons with your competitors, or browsing their financing options.

You want to reach buyers at the precise moment they’re considering a purchase, before your competition, and with relevant messaging.

3. Video is King

Research that Google commissioned from Millward Brown Digital indicates that 70% of people who used YouTube as part of their car buying process were influenced by what they watched and views on YouTube of test drives, features, and options, and walk-throughs have doubled in the past year.

Consumers tend to search out videos at the beginning of the car buying process. The 3 types of videos consumers spend the most time watching include:

- Test drives of specific makes and models

- Videos that focus on features of different makes and models

- Interior and exterior car walk-throughs

4. Consumers Expecting a 24/7 Real-Time Response

According to a study by Arthur D. Little, dealers’ average response time is 9.2 hours and OEMs average time is around 24 hours. This is a huge opportunity for improving the overall customer experience.

5. The Role of Integrated Mobile Apps

Integrated mobile apps and connected vehicle services deliver more value for the customer, enhancing customer loyalty after the initial car purchase.

A study by DMEautomotive showed that vehicle buyers using a branded app were 73% more likely to make a purchase from the dealership, and after making a purchase, booked 25% more service appointments than shoppers without an app. They also spent more money than non-app users when purchasing a vehicle, 7% more according to a study commissioned by Cars.com.

A study by Google found:

- 40% of shoppers discovered a new vehicle they weren’t previously considering because of video marketing.

- The watch time of vehicle test drives on YouTube has increased by more than 65% in the past two years.

- 75% of auto shoppers say that online video has influenced their shopping habits or purchases.

- 64% of shoppers who watch online videos say they prefer new formats such as 360 videos– and that they would convince them to buy a car without a test drive. – Google.

6. Digital Tools

According to a recent study conducted across all age ranges, 66% of car buyers are using online tools (apps/social media/websites) to research a car purchase, such as price calculators, automated vehicle configuration tools, etc. – 59% surveyed selected a price calculator was their favorite online tools. EY Mobility Consumer Index.

7. Go Beyond the Showroom

In 2025 the dealership remains a vital touchpoint, however the customer journey increasingly begins and evolves online.

You need to create an online experience that draws customers in and offers them an immersive experience of your brand, that goes beyond static landing pages with a telephone number or pop-up car salesman.

You should include interactive 360° vehicle tours and augmented reality (AR) features that allow your customers to literally visualize your cars in their own driveways. Go even further with virtual reality (VR) test drives.

Imagine your customer falling in love with their new vehicle on your site, before they even need to set foot on your lot.

8. Influencers are the New “Word of Mouth”

Consumers have been turning to social media influencers in current years, as the trusted source for information and recommendations.

Partnering with influencers who have built trust with your target demographic is a great way to get in front of them in an authentic way. They can be a well-known reviewer with an established following in your area, or even a car enthusiast who can share your brand with their niche audience, in a genuine way.

Authenticity is the key here. Today’s consumers are savvy and they know an inauthentic affiliation when they see it.

9. Marketing Automation Tools

Dealerships are continuing to adopt marketing automation tools to automate and personalize communications with new prospects. For example, if a website visitor fills out an online form expressing interest in a certain vehicle, an automated email can be triggered with information about that vehicle and an alert can also be sent to the sales team for follow-up.

Dealers using marketing automation are 2x more likely to see a higher marketing ROI than dealers who do not use marketing automation. Dealerships are also utilizing the data they have on hand for personalization when contacting a prospect.

The most common pieces of consumer data include basic contact details, vehicle interest, and purchase/service history.

10. Leverage New Technology to Target In-Market Buyers

Advancements in data insights and mobile technologies have also given dealerships new ways to target in-market auto and service shoppers by mobile IDs. Mobile targeting has generally taken the form of audience targeting, such as targeting based on device, apps, site user is visiting, and assumptive “look-alikes.

Real-time location targeting targets every device within a store’s proximity such as beaconing and geofencing. However, unlike traditional mobile marketing, which only targets the device, new technologies can target the actual consumer during the crucial 48-72 hour period when they’re making a buying decision.

Mobile signals to give dealerships the ability to identify which of their customers and prospects are visiting competing dealerships and which dealerships they are using for service.

Mobile signals are different from traditional mobile marketing or lead products because Signals leads represent real people who are actively shopping at a dealer lot. Mobile devices are matched to actual people, including demographics, contact information, and VIN data.

Additionally, machine learning algorithms can identify consumers who have the same behaviors and traits as those identified as shopping for a car. Predictive modeling services can forecast who will be shopping in the next 90-180 days.

11. Life Events Drive Purchase Intent – Target New Movers

The majority (90%) of new movers are open to trying new brands for any items and services. Good reviews (56%), better prices than other brands of the same industry (51%), and recommendations (48%) are the top factors that entice new movers to try new brands.

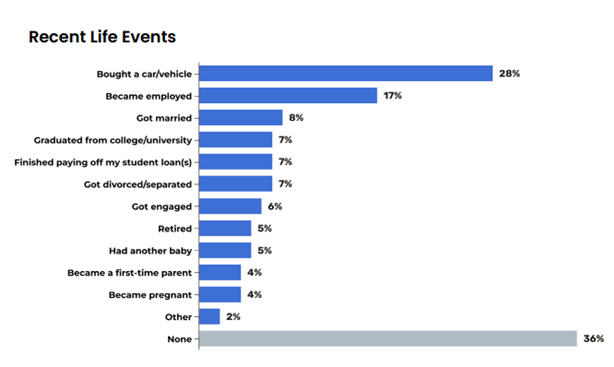

The data confirms that there may be a connection between recent life events and moving. 28% of new movers purchased a car/vehicle.

For example, did you know that 1 in 4 new movers purchase a car?

1 out of 4 New Mover Households Buys a Car

12. Invest in Email Marketing

Email marketing is still an important part of the automotive marketer’s toolbox. The average expected ROI is $40 for every $1 you spend on email marketing – Oberlo.

- Email to New Movers in your community….90% of New Movers are willing to try a new brand – PGM.

- 49% of emails are opened on Mobile Devices – HubSpot…the importance of responsive email templates that render correctly on mobile devices.

- Personalized emails that use a first name in the subject line are 20% more likely to be opened – Forbes.

13. Digital Marketing Ad Spend Increased

In 2024, the automotive segment was one of the highest spending categories in the U.S.

- The automotive industry’s digital ad spending in the US reached $6.9 billion, representing 56.1% of all paid media, with a projected 3.1% year-over-year growth.

- 65 percent stated they were expecting to increase their social media advertising spending in 2024.

14. CTV Advertising is on the Rise

Connected TV (CTV) is beginning to solidify its position as one of the most crucial channels for automotive marketing. It offers dealerships and manufacturers a very sophisticated way to reach those potential buyers.

61% of car shoppers say CTV ads influenced their purchase decisions.

Streaming services are being used in majority of U.S. homes, therefore streaming ads will provide you with access to a large (and very engaged) audience.

These viewing platforms give your brand unmatched targeting capabilities, allowing for segmentation and therefore personalization you can’t get from other channels. You can utilize data to target based on demographics, interests, viewing habits, and even towards those who are in-market with automotive needs.

This level of precision ensures your video ads showcasing your latest models, dealership offers, and brand messaging are delivered to households who are actively considering their next vehicle purchase.