The rise of e-commerce and advancements in technology have led to significant changes in the automotive aftermarket industry, with online sales and digital platforms playing an increasingly important role.

As a result, automotive aftermarket marketing strategies must be adaptable and data-driven to keep up with the evolving trends and changing customer behaviors in the industry. Read on to explore the latest automotive aftermarket trends and statistics to power your marketing performance.

5 Automotive Aftermarket Trends and Statistics

1. Revenue Growth

In 2022, the U.S. automotive aftermarket industry saw a year-over-year increase of 7% in sales revenue. Growth was fueled by auto maintenance – fluid changes, repairs, and tire replacement. Appearance and accessory categories were the only areas showing a decline in sales.

Some of the factors driving the growth of the automotive aftermarket are the lack of new and used vehicle inventory, the jump in new and used vehicle prices, and the increase in loan interest rates.

A new research study has predicted that the global automotive aftermarket industry is expected to reach $837MM and have a CAGR (compound annual growth) of 6.5% during 2022-2031 – ResearchDive

Study Highlights

- The electrical products sub-segment is predicted to be the most productive.

- The OEM (original equipment manager) segment is forecast to have the fastest growth during this timeframe. OEMs provide an upgrade to the market by providing aftermarket activities that promote customer comfort and ease of transportation. The diverse aftermarket services by OEMs improve services and lead to increased customer retention.

- Increased adoption of e-commerce coupled with the increasing complexity of automotive components is forecast to create large growth opportunities.

- New processes that prolong automobile components and accessories may restrict the growth of the automotive aftermarket during this period.

- The Passenger Vehicle sub-segment is predicted to be the biggest money-maker. More consumers wish to improve the appearance and safety of their vehicles – and this will contribute to the growth of the automotive aftermarket in this segment. Additionally, the passenger vehicle sub-segment has demonstrated a rising growth in the need to frequently replace components.

2. More Older Vehicles on the Road

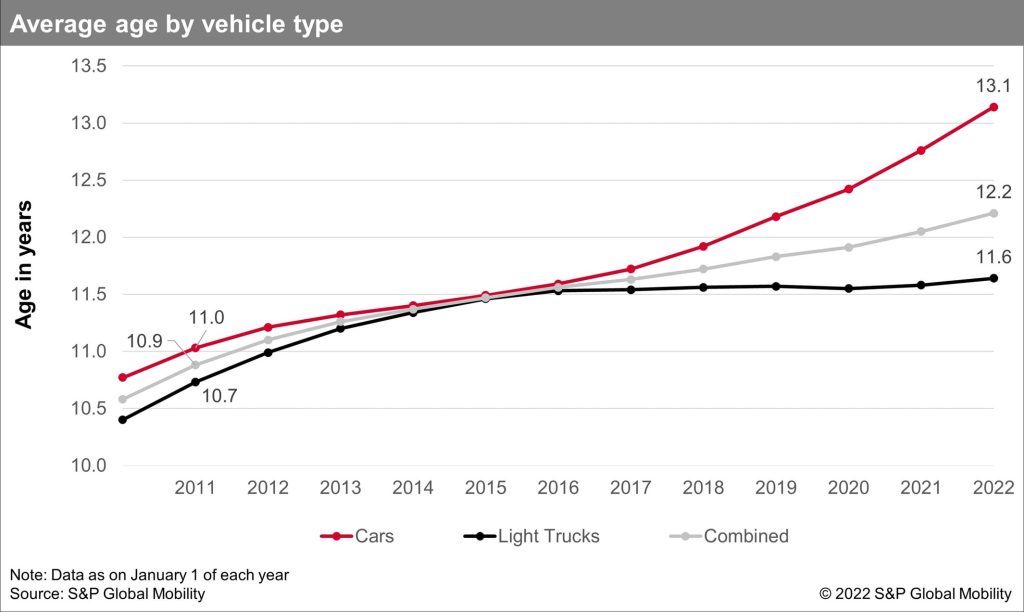

The average age of all U.S. vehicles on the road in 2022 hit an all-time high of 12.2 years in 2022, and 13.1 years for passenger cars, according to S&P Global Mobility.

3. A Tale of Two Economies

Higher Income Consumers

Although the age of vehicles on the road may be aging, consumers are continuing to purchase new vehicles. A recent study forecasts 3% year-over-year sales growth for new vehicles in 2023, despite the average price of $46,507 for new vehicle in U.S (December 2022) – nearly 5% higher than the previous year. Kelly Blue Book.

Americans are selecting more expensive cars – partly due to automakers building fewer inexpensive cars. Supply chain issues, inflation, and the increase in interest rates from the Federal Reserve has impacted vehicle purchase price. Automakers have in turn responded by removing lower priced vehicles from their lineup – and increasing production of more expensive vehicles to market to higher income buyers that they feel have the means and credit to purchase them. Kelly Blue Book.

During the pandemic, almost all the growth in the DIY automotive segment was fueled by households earning $100,000 or more. No longer confined to the home, this segment has redirected their extra income to things like travel and experiences, and it is unlikely that their interest in DIY auto care will continue at the level seen during the pandemic.

Lower Income Consumers

Households earning less than $50,000 have traditionally been the sweet spot for the DIY automotive market, but rising inflation and shrinking purchase power has impacted this segment. Struggling with increased prices of basics such as rent, gas, and groceries – lower-income consumers have deferred maintaining their vehicles to stretch their household income – npd

4. Market Trends to Watch

- Although the delivery time for chips improved toward the end of 2022, the supply of chips for automobiles remains restricted – sema

- The rise in popularity of electric vehicles will fuel the demand for electric vehicle components and charging and maintenance solutions. – cascade business news.

- The popularity of Advanced Driver Assistance Systems (ADAS) has spurred a growth in auto aftermarket demand for technologies to improve road safety such as cameras and sensors.

- Artificial Intelligence (AI) will impact the automotive aftermarket by allowing companies to predict trends and issues, and to make recommendations to drivers for repairs and maintenance. cascade business news.

- The widespread adoption of e-commerce has resulted in increased competition and lower prices for aftermarket products. – cascade business news.

- Although there has been a growth in online sales, 81% of automotive aftermarket consumers prefer to shop in a brick-and-mortar store as opposed to online – Auto Service World

5. E-Tailing in the Aftermarket

According to a recently released report, the global automotive e-tailing (e-retailing) market size is forecasted to grow by over 79 million between 2022 and 2027. Better built vehicles with long-lasting engines have enabled consumers to keep their cars running longer, and the scarcity of new vehicle inventory from chip and supply chain disruptions, coupled with the rise of vehicle prices and other economic forces, have driven consumers to keep their vehicles longer – presenting market growth opportunities for automotive aftermarket e-tailing.

For both audiences, online and retail, be sure to analyze your data to really understand who your audience is – so that you can target them with personalized offers. Analyze past purchase data, append missing demographics or firmographics, and ensure that email addresses and phone numbers are up to date. By providing a meaningful and personalized experience, both offline and online, you can maximize customer lifetime value, procure new business through referrals, and boost customer retention.

4 Key Marketing Opportunities for the Auto Aftermarket Industry

1. Target Consumers by VIN

- Acquire acquisition marketing audiences to target consumers based on demographics, vehicle age, and more. Example types of automotive fields include Make, Model, and Year as derived directly from VINs.

- Detailed selection criteria such as engine size, fuel type, drive train, wheel size, engine block, and engine cylinders.

- Vehicle owner details and demographics including validated emails and phone numbers, and demographic selects such as occupation, gender, estimated income, age, credit card, language spoken, hobbies, purchase behavior, lifestyle interests, or other indicators that may be indicative of your target audience. Porch Group Media offers solutions to market to these audiences through email, direct mail, social media, and connected TV.

2. Reach Out to New Movers

Using new mover marketing strategies can boost both your customer acquisition and retention strategies. New mover targeting allows you to know when your customers move so you can retain them at another location and can also be used to welcome new prospects who have just moved to your area before they go somewhere else. Additionally, Porch Group Media can review your current customer list and flag new movers.

Key New Mover Statistics

- The average business needs to replace about 20% of its customer base that move away in any given year.

- New movers spend more in the first six months of a move than the average consumer will spend in three years.

- 9 in 10 new movers are willing to try new brands.

- New movers are 5 times more likely to become your loyal customer if you reach them first.

3. Ramp Up Your Digital Presence

Email content, videos, and social posts are all high drivers of website traffic. Website landing pages are still one of the top ways prospects provide information or show interest in your products and services. So be sure to continually optimize your website with fresh content and continually share with third-party sites.

SEO is also an integral component of an integrated digital marketing strategy. According to research by Google titled “Understanding Consumers’ Local Search Behavior”:

- 4 in 5 consumers use search engines to find information before making a purchase decision.

- The higher you rank on sites such as Google and Yahoo, the better the results.

- 53% of searchers click on the first organic result, with 25% clicking on the second and third results.

Websites, content, and marketing messages must also be optimized for mobile. When a consumer visits a page that is not mobile-friendly, they will quickly leave in search of a competitor who can deliver an optimized mobile experience.

4. CTV and Automotive Aftermarket

Connected TV is becoming an increasingly popular channel for the automotive aftermarket. Unlike traditional TV advertising, CTV advertising allows for precise targeting and attribution. Marketers in the auto aftermarket industry are using this valuable channel to increase customer acquisition and engage their existing customers.

Connected TV solutions are precisely targeted and trackable and are proven to help you increase customer engagement. Porch Group Media offers CTV solutions coupled with an audience connection of over 270 million consumers, 200+ million VINs, and 170 million email addresses. Our targeted automotive aftermarket audiences provide the insights you need for the right consumer connections to increase service appointments and sales.

As vehicles on the road continue to age, there will be an ever-growing demand for parts and services. Be sure to get your brand in front of these consumers with the most targeted and relevant offers. And next time a driver needs automotive aftermarket parts or services, you can ensure your business is the one servicing the customer.