The remodeling market shows no signs of slowing down, but what people are remodeling—and why—is shifting.

In 2024 alone, Americans spent an estimated $603 billion on home renovation. By mid-2026, spending growth is projected to continue, though at a slower pace of ~1.2% year-over-year.

That means opportunity is still there, but brands will need to understand the drivers behind homeowner decisions to target them effectively.

Here’s a look at the trends shaping remodeling in 2026—and what they signal for marketers.

8 Remodeling Trends for 2026

1. Remodeling for Practical Needs

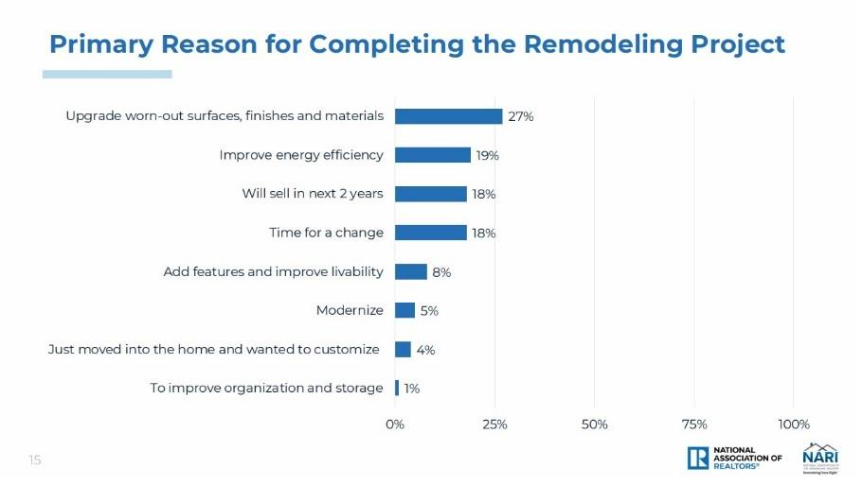

One of the top reasons homeowners renovate is for practicality. According to a remodeling report by NAR, these include:

- Upgrading worn-out surfaces, finishes, or systems (27%)

- Energy efficiency improvements (19%)

- and resale preparation (18%)

In 2026, with affordability challenges limiting moves, more households will choose to improve their current homes rather than buy new ones.

What This Means for Marketers:

Position upgrades around ROI such as cost savings, reduced repairs, and higher resale value. Messaging like “lower bills, higher home value” may resonate more than purely aesthetic appeals.

2. Energy Efficiency and Sustainability

Utility costs are climbing, and consumers are more eco-conscious than ever. In fact according to NAR, 19% of remodels in 2025 were motivated by efficiency gains. With expanded state and federal incentives, this share is expected to grow in 2026.

Expect continued demand for:

- Energy-efficient windows and insulation

- Solar-ready roofs and panels

- Smart thermostats and appliances

- Eco-friendly building materials

What This Means for Marketers:

Connect efficiency upgrades to long-term savings and environmental impact. Tie promotions to rebates or incentives to help homeowners see immediate value.

3. The Rise of DIY and Hybrid Projects

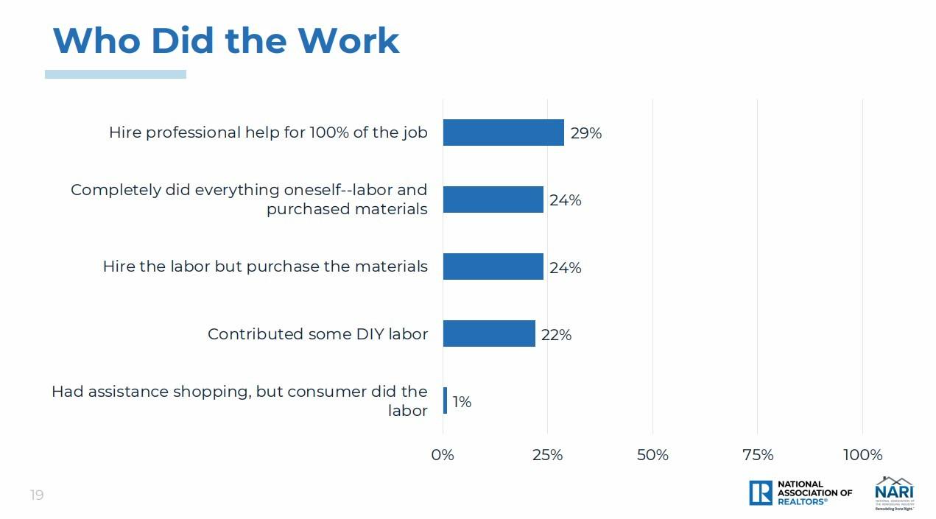

DIY remodeling remains strong. In 2025, 24% of homeowners did projects themselves and another 24% took a hybrid approach—purchasing materials directly while hiring out labor.

Platforms like TikTok and YouTube continue to fuel the DIY culture, while rising labor costs push some households toward partial DIY solutions.

Critical projects such as electrical, roofing, and HVAC, however, will continue to lean on professionals.

What This Means for Marketers:

DIY and hybrid remodelers demand a dual approach. Inspire homeowners with bundles and kits to make DIY less intimidating, while also supporting contractors with loyalty programs and training to influence brand choice on bigger jobs. Brands that serve both audiences will capture the full remodeling spend.

4. Lifestyle-Driven Remodeling

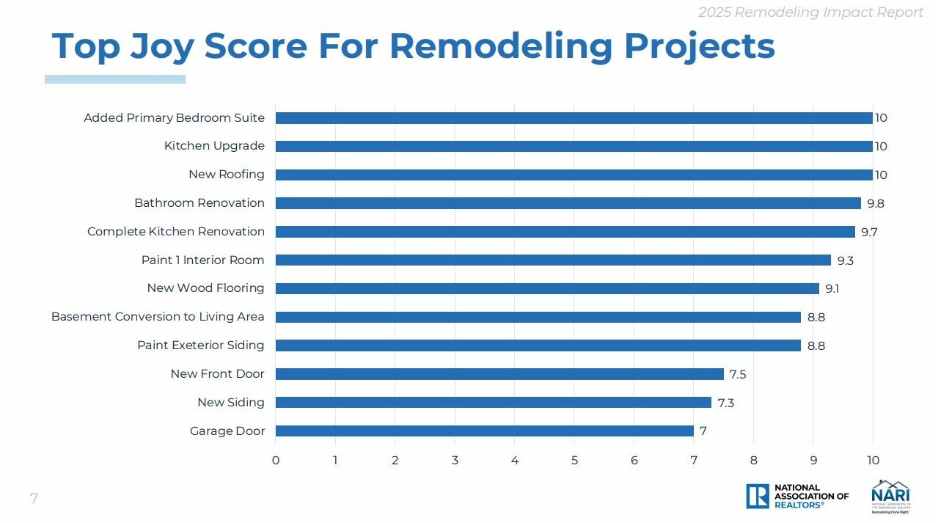

While practicality is a big driver, not all remodels are about need. Lifestyle upgrades such as kitchen remodels, primary suite additions, and outdoor living projects rank among the most satisfying, scoring a Joy Score of 10/10 in the NAR Remodeling Impact Report.

In 2026, expect projects focused on wellness and lifestyle enrichment: spa-like bathrooms, multifunctional kitchens, outdoor entertainment areas, and home gyms.

What This Means for Marketers:

Play up the emotional payoff. Campaigns that highlight joy, family connection, and personal comfort will outperform purely functional pitches.

5. Financing Shifts How People Remodel

How homeowners pay for projects is also shaping the market. In 2025:

- 54% used a home equity loan or line of credit

- 29% used savings

- The remainder relied on credit cards, alternative lenders, or point-of-sale financing

With interest rates still fluctuating, financing will be an even bigger factor in 2026.

What This Means for Marketers:

Pair promotions with financing education. Campaigns that highlight affordability such as “$150/month for new windows” vs. total project cost will lower barriers and increase adoption.

6. Aging Housing Stock Drives Demand

Nearly 48% of U.S. owner-occupied homes were built before 1980 (Eye on Housing), and that number continues to rise as newer construction lags demand.

These older homes require updates to roofing, plumbing, HVAC, windows, and insulation—creating a steady pipeline of remodeling demand.

What This Means for Marketers:

Use property condition data to anticipate need. Windows or roofs in need of repair or replacement is a clear opportunity for targeted outreach.

7. Technology and Smart Homes Go Mainstream

Home technology is no longer a “luxury add-on.” In 2026, smart appliances, integrated security systems, and automated lighting will increasingly be baseline expectations for homeowners (NAHB Remodeling Forecasts).

What This Means for Marketers:

Position smart home upgrades as future-proofing investments. Highlight convenience, energy savings, and integration across platforms to appeal to both younger buyers and older households looking for simplicity.

8. Wellness and Accessibility Upgrades

Baby Boomers and Gen Xers aging in place are fueling demand for accessibility-focused remodels—walk-in showers, wider doorways, stair lifts—while younger buyers prioritize wellness features like saunas, meditation rooms, and air quality systems (Harvard JCHS).

What This Means for Marketers:

Don’t stereotype older audiences as “offline.” Many are tech-savvy and looking for smart, safe upgrades. Campaigns that focus on comfort, health, and long-term livability will resonate across age groups.