Owning vs Renting Behaviors

Luci:

One of the big surprises to me in the data is the high percentage of millennials who are moving, 46% of this survey which is almost double compared to other cohorts we have looked at.

I’ve been studying movers for at least a decade in different industries that I’ve worked in. Movers are a very important segment for telecom. I was the CMO at PODS which is directly in the moving and storage industry.

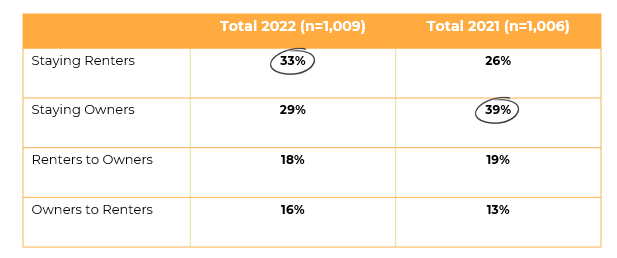

Two huge shifts here we are seeing is the huge percentage of folks who are remaining renters. And even though we were showing the biggest cohort of homeowners as being those who are first-time owners or those who were moving up, there is a large percentage of people who are in homes or home families who are remaining renters. And that grew substantially year over year.

And then the converse. Folks who are staying owners decreased by a huge margin – a 10% points decrease for those staying owners and a 9% point increase for those staying renters. What do you think’s happening here, David? This has been such a surprise to me.

David:

I agree. Last year, we did this survey probably last summer, and then this new survey was done this summer. And obviously in the last 12 months, there’s been a lot of discussion about interest rates and the impact of interest rates on mortgages and it’s impacted the home buying situation.

So, I suspect that this data is kind of reflecting where people stand right now in terms of whether or not they do they want to invest in a mortgage with higher interest rates and therefore perhaps if they have to move, they will postpone it and just rent for another year or so and see where we are. That’s my speculation at this point that that’s what this data is reflecting.

Luci:

We have some data in this survey for sure where the interest rates are affecting those folks and they either took the opportunity to sell when the market was still high and shifted to being a renter or opted not to buy. It’s interesting because here is when the millennials come in and we know for years there’s been a declining inventory of homes to buy for first-time homeowners.

We’re still seeing a good percentage of homeowners become first-time homeowners, but that inventory level of a first-time home is declining. So, you’re seeing millennials who are choosing now to stay renters and also to move as renters. And typically, renters do move more than homeowners.

That’s why in some ways that large millennial number wasn’t as surprising, knowing that year after year, that inventory of those first-time homes is declining and continuing to decline. And then couple that with interest rates rising, you have millennials, the largest segment of the population, really delaying homeownership each year. Then therefore, the move rate is increasing because they’re forced to remain as renters. So, some of that wasn’t surprising.

That’s creating an issue because now there are declines in inventory and rental inventory and prices are going up. When you have supply go down, the price is going up and it’s really just creating I’d say this whole kind of full circle of problems in terms of people finding a place to live and being able to expand their homes as their families expand and so forth.

David, do you think that as long as the interest rates are up, do you think we’ll see this trend reversing or do you think we might be sitting in it for a while?

David:

Although I’m not an expert on the real estate market itself, that’s what I think until interest rates either stabilize or start to go down. I think we’re in this for a while. That would be my speculation.