Economic difficulties caused by COVID19 have put huge strains on businesses and operations. Marketing departments are certainly no exception and have been forced to balance between cutbacks in spend while still maintaining acquisition and retention strategies to thrive during these difficult times.

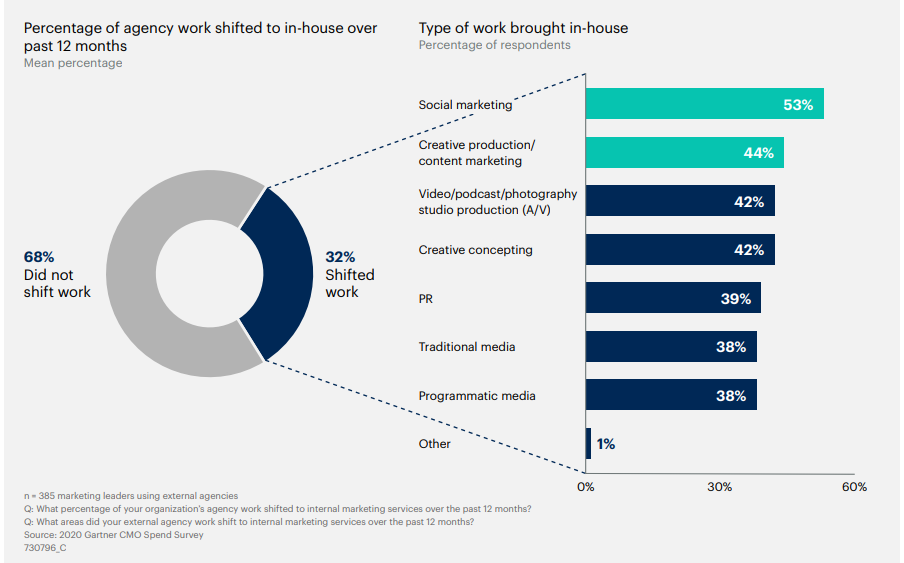

In recent researched conducted by Gartner, 44% of CMOs surveyed in April and May 2020 said they are facing midyear budget cuts in 2020 as a result of the pandemic. One change CMOs are making due to these budget pressures is shifting outside agency work to in-house employees. In fact, respondents reported that almost 32% of work has shifted from external agencies to in-house teams and this trend is only expected to grow.

Types of work brought in-house include:

- 53% – Social Marketing

- 33% – Creative Production/Content

- 42% – Video, podcast and photography work

- 42% – Creative concepting

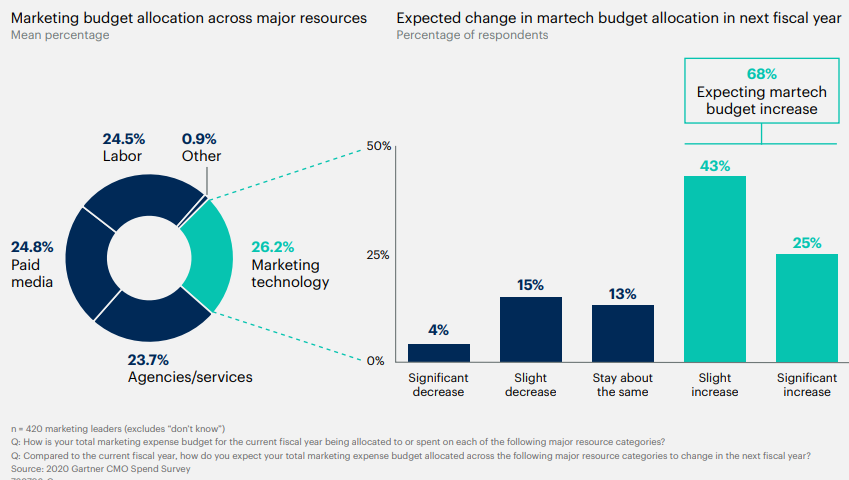

Martech continues to be a strong category in which CMOs are spending. According to Gartner’s report, in 2020, technology spend will account for the largest proportion of marketing budgets when compared with media, agencies and in-house labor. In fact, 68% expect their investments to increase over the next 12 months.

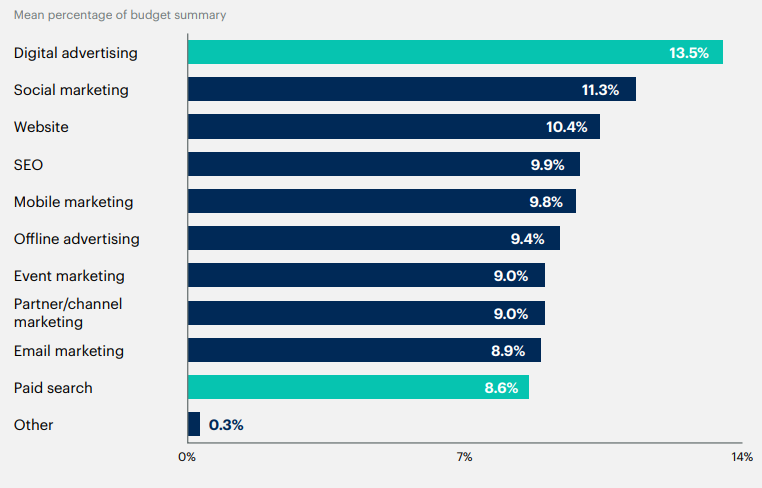

Spend is also increasing for digital advertising as consumers head to online channels for information. CMOs said they spend nearly one-quarter (22%) of the marketing budget on digital advertising (13.5%), including display, video or ads on platforms like Amazon, and paid search (8.6%). Another 59% used owned and earned digital channels such as social marketing, the website, SEO and mobile marketing.

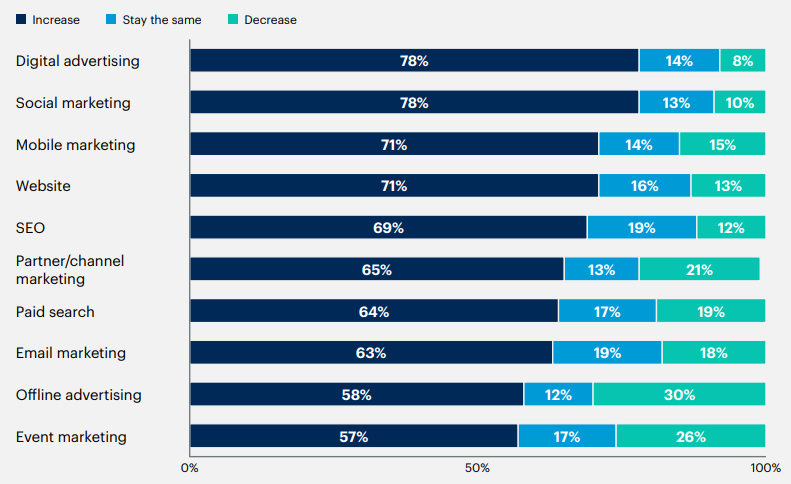

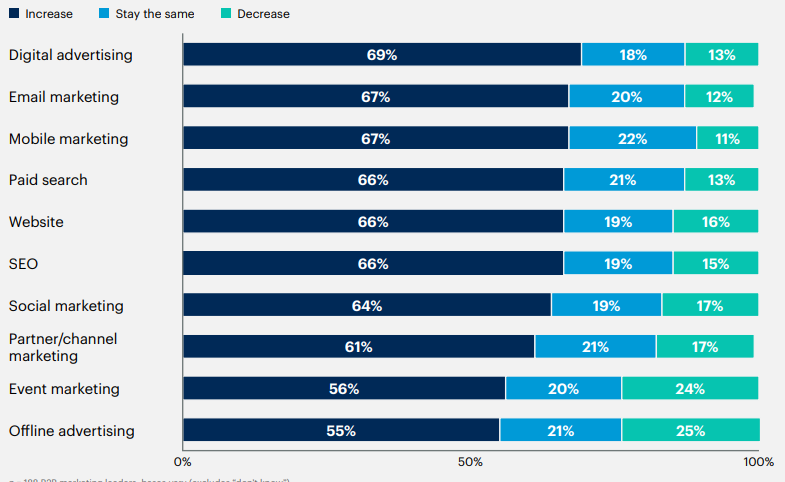

In looking forward to 2021, CMOs expect increases in certain categories. This varied slightly for B2C and B2B marketers. In B2C, channels such as digital, social, mobile and website all expected to see increases in budget for a large percentage of marketers.

In B2B, increases in spend were expected by a slightly lower percentage of survey participants in categories such display, email, mobile, paid search and SEO.

In other research by Forrester, forecasts were not quite so optimistic. Forrester’s report outlines three possible recovery scenarios for marketers: A late-2020 recovery, a mid-2021 recovery and a late-2021 recovery. The most likely probability, according to Forrester’s research, is a mid-2021 recovery — but even in the best-case scenario of a late-2020 recovery, CMOs will likely lose $222 billion of their budget.

Forrester does predict that CMOs will continue to invest in marketing automation platforms with an increase of 3% in investments.

In some great research compiled by Marketing Charts, here are other updates on Coronavirus and the impact on marketing:

- Social media budgets accounted for almost one-quarter (23.2% share) of total US marketing budgets in June, up from 13.3% in February, with CMOs prioritizing the use of social media to build their brand and retain customers. Read more here.

- Small businesses have been hit hard by the pandemic, with 8 in 10 small business owners reporting that it has had a negative impact on their business. That said, all of those small business owners surveyed say they have used the time to build their business, with 76% saying they have upskilled in areas such as SEO, social media and data analytics. Source: Tech.co.

- Many marketers have used this time to try new marketing technology and features, with at least half investing in technologies such as site/mobile chat (56%), mobile app functionality (55%), email (51%) and video (50%). Read more here.

- As a result of the pandemic, 7 in 10 (69%) CMOs have asked their employees to get active online in order to promote the company and what it has to offer. Read more here.

- Although the pandemic has led to a great deal of uncertainty, consumers are still shopping, and advertising is still a driver in purchase decisions. More than one-third (36%) of US consumers surveyed report they have made an impulse buy based on an ad since the start of the pandemic. Advertising isn’t the only driver – they still like a good deal, with some 76% reporting that they have discovered new products based on deals they have received from brands. Source: Valassis.

- During the pandemic, more than half (53%) of American consumers say they have purchased brands they would not normally purchase. But that’s not to say that this behavior will stick post-COVID-19, with about three-quarters (77%) claiming they will return to their favorite brands at that time. Source: MRI-Simmons.

Many CMOs are placing renewed emphasis on customer retention during these times. Keeping current customers is priority yet opportunities exist to appeal to consumers who may be shopping online for the first time, using social media channels for purchasing, and tuning into emails for deals and coupons. Now is the time to put acquisition strategies in place to attract a new breed of consumers and nurture them into long-term brand advocates.

Interested in learning how Porch Group Media’s marketing and technology solutions can help you navigate today’s new normal? Click here to learn more.